Is “Smartest Credit Card Ever Created” Really That Smart?

The highly publicized X1 credit card, billed as “the smartest credit card ever made,” is now finally available to the general public, but is it as innovative as its marketing suggests? Indeed, there are some unique perks as well as a good reward rate, especially for free cards, although the redemption options for rewards are more limited than what you see with other more traditional cards.

How does X1 card work?

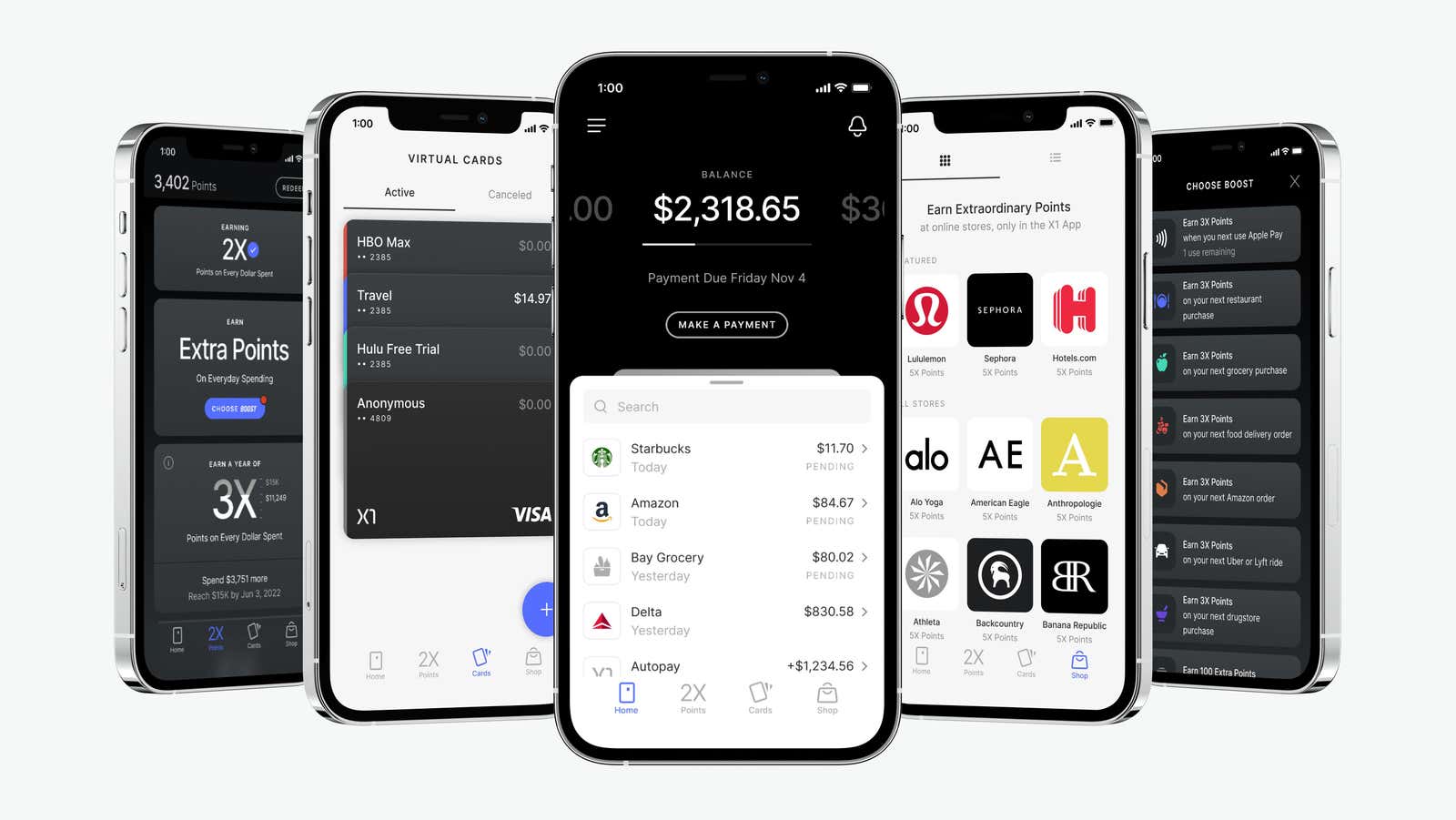

Backed by PayPal co-founder Max Levchin, X1 offers smart deals that traditional lenders don’t have. This includes the ability to automatically end free trials, cancel subscription payments with one click, and create disposable virtual cards for increased privacy.

In particular, the credit limit and interest rates on the card are based on “current and future income,” not your credit rating. As a result, the company claims credit limits are up to five times higher than traditional cards; for this reason, the card is well suited for borrowers who have either a poor credit rating or a limited credit history.

Other features include:

- No annual and overseas transaction fees

- Two points per dollar for each purchase

- Three points per dollar per year if you spend $ 15,000 or more this year.

- Four points per dollar per month for each referral who subscribes to the card

- Relatively low variable interest rates from 12.75% to 19.75%.

- Benefits and benefits of Visa Signature

Two points for every purchase is a competitive rate when compared to similar free cards, but three points for every dollar spent on a purchase is really good if you usually spend $ 15,000 a year using a credit card. Combined with an extra credit limit and no fees, X1 can be a reliable everyday credit card.

The X1’s rewards are a bit of a compromise, however.

While reward multipliers compare well with similar free cards , reward payouts are less reliable than traditional lenders:

- There is no welcome bonus or introductory annual percentage rate offers – often this value is $ 1,200 if you meet certain spending goals (for example, spend $ 5,000 in three months).

- There are also no offers with a discount on the introductory annual interest rate (other cards often offer 0% for 12-18 months).

- Points can only be redeemed for 45 listed brands , including Apple, Nike, Patagonia, Wayfair, Hotel.com, Vrbo, Airbnb and some major airlines. You should make sure the partnerships are already aligned with your spending habits before switching to the card (you can also redeem points on the credit report, but the rate is less beneficial compared to paying off the rewards through the X1 partnership).

Bottom line

The X1 is a good everyday card for people with a decent income but less than a decent credit score, especially if you spend enough to qualify for a bonus of three points per dollar spent. Other features, such as automatic cancellation subscriptions and one-time use of virtual cards, are pretty smart and seem like a step forward when it comes to credit card features.

However, the reward payouts are limited, so you should make sure the partnerships with the card are in line with your current habits. Otherwise, this is a good option if you are looking for a card with no annual fee.