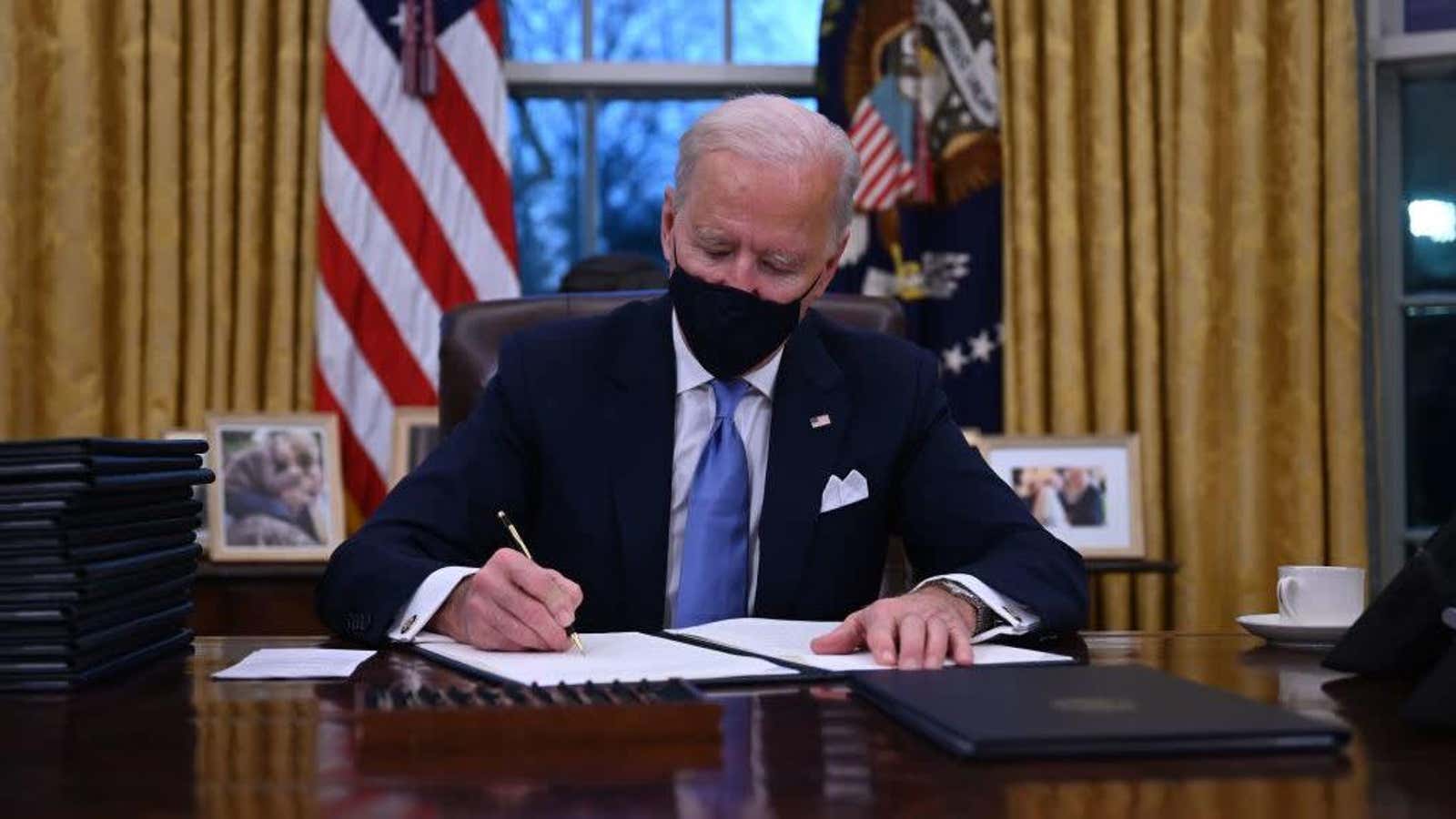

How Will Biden’s Executive Orders Affect Your Debt?

President Joe Biden signed 17 decrees on his first day in office, including an extension of the moratorium on evictions and student loan payments – measures that will provide temporary relief to the millions of Americans currently withholding payments as a result of the pandemic.

Extended moratoriums on evictions and foreclosures

The current moratorium on evictions and foreclosures was due to expire on January 31. Biden’s executive order asked the CDC to extend the moratorium to at least March 31, and this request was accepted (the CDC has a long-standing mandate to impose such moratoriums while it relates to the fight against the spread of infectious diseases).

Biden also asked the Department of Veterans Affairs, the Department of Agriculture and the Department of Housing and Urban Development to extend the moratorium on government-guaranteed mortgages and the deadline for filing termination petitions until the end of March.

Along with extending the moratorium, Biden’s economic plan includes additional $ 25 billion in rental assistance to low-income households affected by the pandemic on top of the $ 25 billion in rental assistance currently available . Another $ 5 billion has been given to people struggling to pay overdue utility bills.

More than 10.1 million households in the United States were unpaid rent as of last December, according to a poll by the US Census Bureau . Another study shows that people who have lost their jobs as a result of the pandemic now owe an average of $ 5,400 in rent and utilities.

Extended pause on student loans

The freeze on payments and interest on all federal student loans, first introduced at the start of the pandemic, was due to end at the end of the month. A new executive order extends the loan freeze by eight months until September 30, 2021. Unfortunately, this does not include private student loans, which Congress will have to consider separately, if at all.

David Kamin, the new deputy director of the National Economic Council, also said that Biden would like Congress to write off $ 10,000 of debt to all borrowers of federal student loans. Other Democrats, such as Senator Elizabeth Warren, pushed for the waiver of a $ 50,000 debt for all student loan borrowers through a decree. However , a recent non-binding memorandum from the US Department of Education questions the constitutionality of such an action, since spending appropriations are usually the prerogative of Congress.

Americans have a surging student loan debt of nearly $ 1.57 trillion, with an average account balance of each borrower of $ 37,584 , according to Investopedia .