How Much Will Medicare for All Cost You?

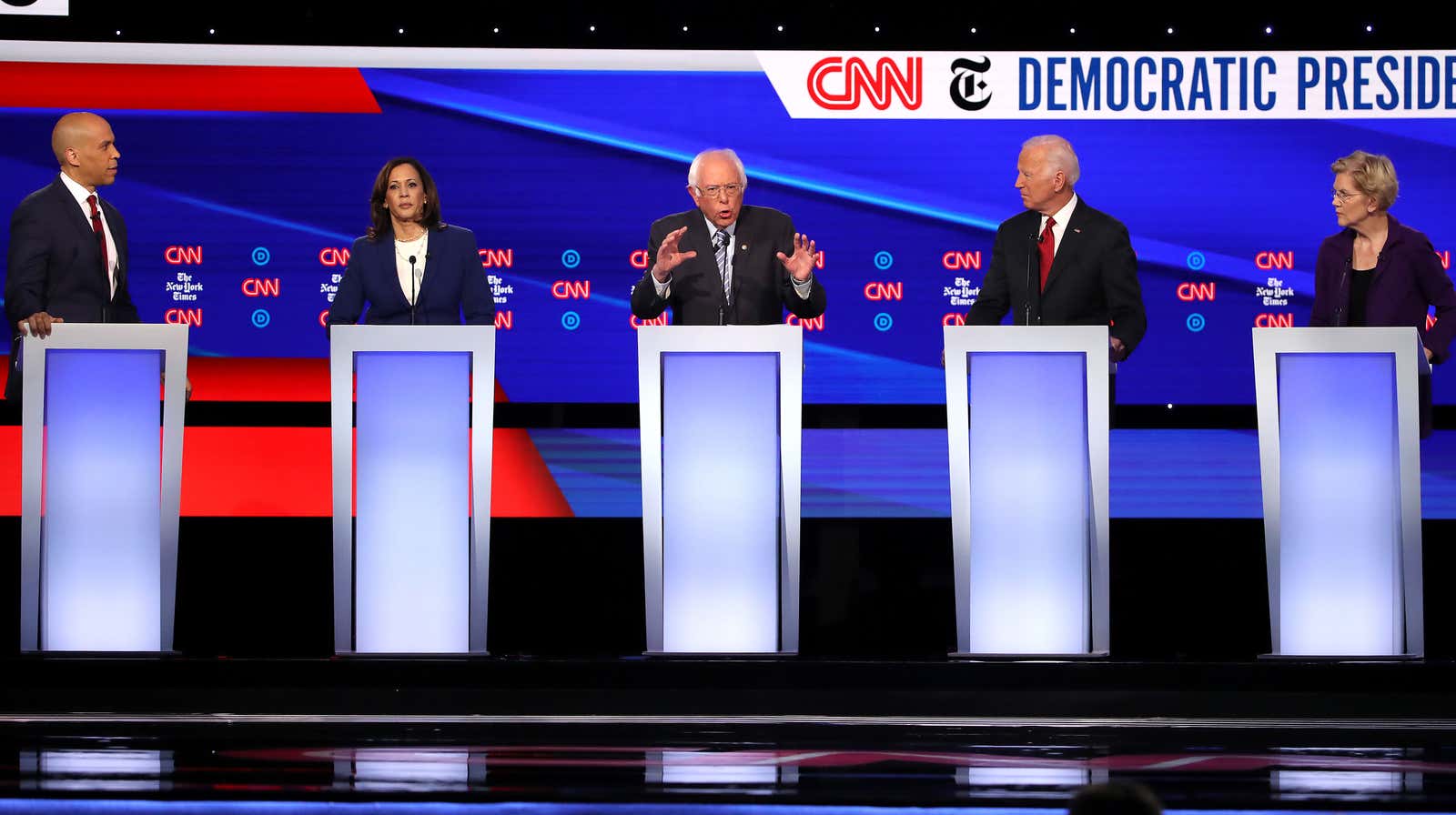

Democratic presidential candidates want to overhaul the healthcare system. But who will pay for it? It was a question during the fourth primary debate last night , which involved 12 candidates on the same stage competing for attention. But a discussion of health issues could lead to more questions than answers. Many details are unclear, but right now it looks like public health care won’t significantly increase your personal spending – it will actually lower your medical costs.

Part of the night was devoted to Medicare for All, the general idea that the government should manage the health care system in the United States. There are several ideas for this, but the overall goal is for everyone to get some level of coverage for free.

Senators Bernie Sanders and Elizabeth Warren are pushing for the end of private health insurance in favor of Medicare for All, while Pete Butegig, Julian Castro, Senator Cory Booker and Senator Amy Klobuchar want to offer a public insurance option alongside private insurance, Andrew Young wants. to the people He told the Washington Post he could choose private or public coverage, but expects public options to eventually crowd out private offerings.

But none of the candidates were particularly clear about how such a universal plan would be funded or how this funding method would affect your bottom line. And that leaves room for Medicare skeptics for everyone.

During yesterday’s debate, former Vice President Joe Biden, who said he would prefer to improve the existing Affordable Care Act rather than launch a new program, said that someone earning between $ 50,000 and $ 70,000 a year, will see the health care tax. an increase of $ 5,000 in Medicare for All.

But that estimate is based on a combination of two potential solutions presented by Sanders in his joint Medicare for All legislation presented this spring, according to Politifact . Reporter Shefali Loutra explains:

Thus, the suggestion that Medicare for All will increase taxes as specifically as Biden is proposing is an inaccurate reflection of the bill. Another problem is that there is no clear idea of how much this health insurance plan will cost, so any estimate of its tax burden is really just an assumption.

Sanders’ office offers the following options: Income tax of 7.5% paid by the employer; an insurance premium of 4% of income paid by households; or raise taxes for the super-rich in several ways. If you look at the income-based 4% premium, Sanders estimates that a “typical middle-class family” earning $ 50,000 would pay this tax after receiving the standard tax deduction. The family will save over $ 4,400 a year.

According to the Kaiser Family Foundation , in 2018, the average annual employer-based family health insurance premium was nearly $ 20,000, of which about $ 5,400 was paid by an employee.

Vox’s 2018 analysis of NYC Health Law data found that new taxes levied on health care services are likely to replace the same amount of money spent on premiums, whether those costs are covered by you or your employer. Here’s a breakdown by Dylan Scott:

Basically, anyone who earns less than 1,000 percent of the federal poverty line – about $ 120,000 per person or $ 250,000 for a family of four in 2018 – will pay the same or less if you look at everything from their personal expenses before taxes. they pay this fund for health care.

During the debate, Sanders said taxes would rise “significantly” for the rich and “for virtually everyone, the increase in taxes would be substantially less” than what they pay out of pocket for health care. Meanwhile, Warren said he would not comment other than stating that she would not sign the health care law unless it cuts costs for middle-class families.