Eight Little Things That Will Save You Money When Shopping

I have a little note that I constantly update and save (using Evernote ), it is full of little tips and strategies that I learn or ponder about and which I want to include in the post at some point. In the end, I amassed a large collection of them. Here are eight of these small shopping strategy ideas that will allow you to spend less money and get fewer things you don’t really need.

This post was originally published on The Simple Dollar .

1. The best place to decide whether or not to buy something is before you even enter the store. Yes, I’ve written many times about the value of a shopping list, but that’s not all. You should never enter a store without the intention of buying something and almost certainly not knowing what you are going to buy.

Why? Stores are there to convince you in endless, sophisticated ways to buy things that you didn’t plan to buy and that you really don’t need. This is their goal. If that wasn’t their goal, stores would be designed differently, with the most in-demand items right in front of the entrance, or even with a picker-style warehouse system. These types of systems work well for customers, but that’s not what retailers want – they want you to buy.

So, treat every store trip as a mission. You are going to buy something special there. Know what that particular thing is before you step there. Don’t go there to socialize. Don’t go hanging out there. Go in there to buy and get out. Find entertainment and free time outside of shopping.

2. When you buy something at a discount, you are not saving money. You just spend a little less. He is still spending money and lowering your net worth. Companies love to let you know how much you “save” by buying something at the selling price. Why, if something starts out at $ 99.99 and they knock it down to $ 49.99, you’re saving $ 50! Right?

In fact, this is not at all the case. If this item was not absolutely necessary for you , you will not save money by purchasing a discounted item. You just don’t spend much. Your net worth is still dropping to afford what you really don’t need.

The reality is that the sale price should only be considered if you have already decided to buy the item. At this point, you are essentially highlighting whatever the value of the item is, so the selling price in this situation actually saves you a little money.

3. Customer reward programs are fine, but there are some tricks. Customer reward programs are designed by companies to keep their loyal customers and keep them coming back to the store. They usually require you to spend a certain amount at the store over multiple visits in order to earn some kind of bonus, like a free sandwich or a free lunch. For example, our local pizzeria has a coupon on every box that entitles you to a free large pizza of your choice when you receive ten.

There are two tricks to watch out for. First, many of these programs want to get your personal information, and when they have it, you will receive spam. This is especially true for email addresses, so my strategy is to have a “spam” address, which I rarely check, and which I use to subscribe to such programs. I’ll check it to see if there are any ongoing deals when I’m about to go out to eat, for example, since the inbox is usually loaded with all kinds of suggestions.

Second, you shouldn’t use a customer reward program as an excuse to waste money. In truth, this is very similar to the sale described above; it really saves you money, but only if you’ve already made a commitment to buy the product. For example, it is much cheaper to cook at home than go out to eat. It’s almost always a lot cheaper to go looking for a great deal than “don’t worry about it” and just go to a familiar store with a customer reward program.

4. When shopping online, always search in reverse order for anything that claims to be a picture of the original product. Every time I see a product on eBay, Amazon Marketplace, or other website with an image that claims to be the original, I copy that image and use Google Image Search to search the web for that image.

I often find that the same exact image has been used elsewhere, which is a sure sign that the image I am looking at is not the original item, and when that happens, I am not buying that item .

Note that this is only true for non-new items. If they are new and in their original packaging, a clear image is completely unnecessary; I only use it on a second hand item where condition is an important factor.

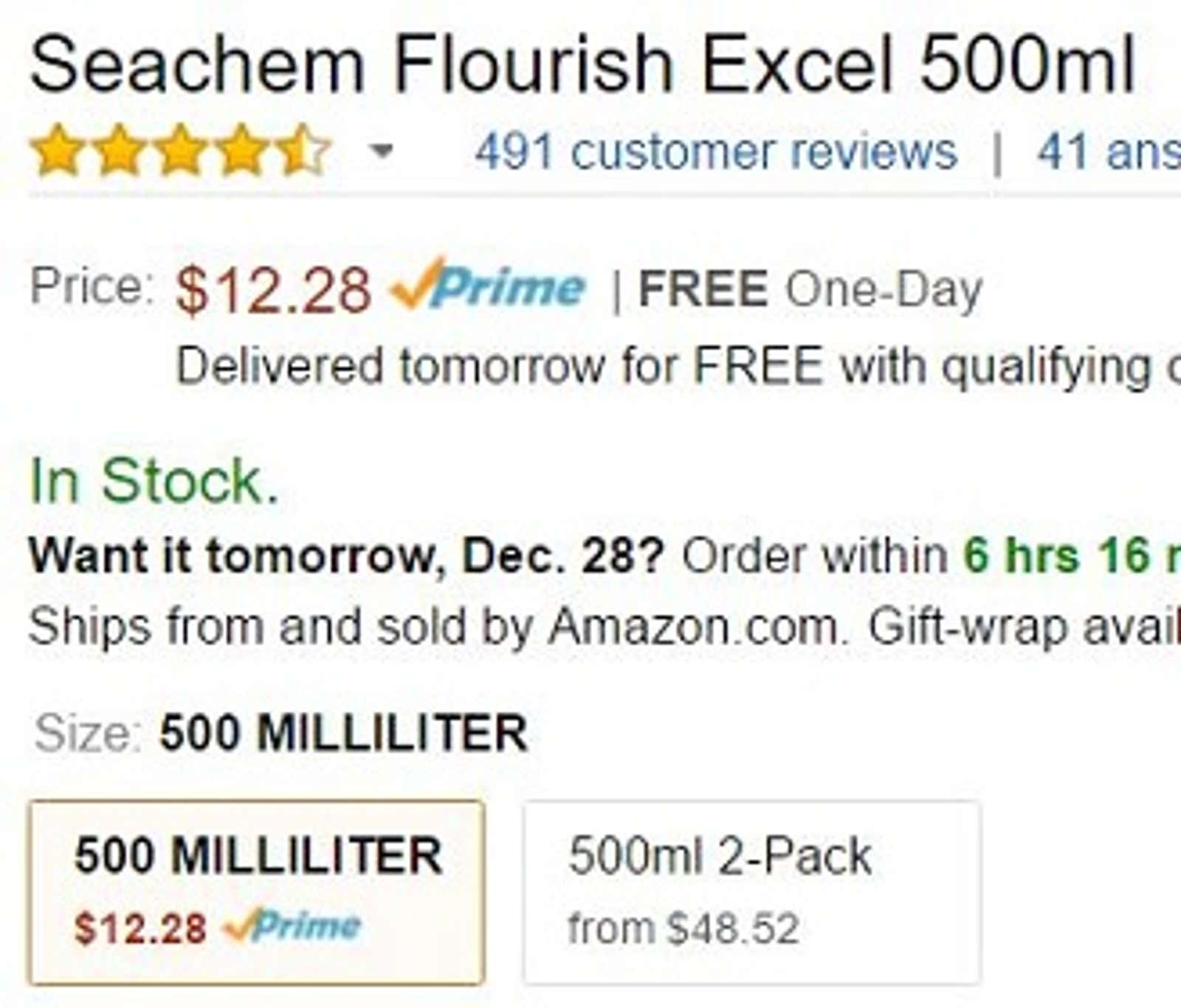

5. When you buy something non-perishable that you use at any frequency, the only price that matters is the unit price. The price of a sticker doesn’t really matter, for example, on a large roll of toilet paper; I only look at the cost of the sheet. The same can be said for things like dishwasher soap, trash bags, rice, and countless other items that we gradually use over a long period of time.

Look at cost per ounce, or cost per pound, or cost per bag, or cost per sheet. Don’t worry about the actual price of the sticker; instead, minimize the unit cost.

Why? You are going to use a certain amount every time you use this item, no matter what package you buy, so if you buy the package with the lowest cost per unit, it will cost you the least amount in the long run. A large container with trash bags can cost $ 30, but if the cost of the bag is lower, you will spend less in the long run. A container of 200 trash bags for $ 30 is a better deal than 50 trash bags for $ 10 each time (assuming they are the same brand).

6. Searching your pantry and closets once a month is the best way to save on groceries. Almost every time I open-mindedly scan my cupboards, I end up finding enough disagreement to cook a few full meals and provide portions of a few more meals. The reason is that when I find a big deal at the grocery store, like cans of good $ 1 pasta sauce or boxes of $ 1 pasta or something, I stock up a lot and then, over the next few weeks, I will forget that I have such things in abundance.

Cleaning the pantry usually solves this problem. I often “combine” foods that I find together into sensible dishes, such as putting a bag of pasta in a pasta jar or putting sauces for frying right next to the rice container. I will then compile a large list of all full – or near completion – meals I already have in the pantry, and take from that list when planning meals for the next weeks or two.

It also keeps me safe from the fact that foods with a long shelf life – but not an infinite shelf life – never run out in the back of the pantry, and it also keeps us from aging herbs and spices.

7. Try to increase the time between shopping trips to keep fresh food fresh in our refrigerator and pantry. For most of our fresh produce, this is usually anywhere from a week to two, so I try to plan things so that the items that fail the fastest are used first, and the other items are left fresher for a while.

The longer I can wait between grocery trips, the less time I have to spend at the store in general, and the more efficiently I work when I really need to go on one of those “mega grocery trips”. The less time I spend in the store, the less likely I am to put impulsive items in the cart, which means that we spend much less on groceries.

8. Take a photo of each receipt you receive with your smartphone. This is the strategy I switched to recently. I used to keep all my receipts in my pocket, but I often found myself losing them or throwing them somewhere along the way, and so the recording was sometimes incomplete.

If I just use my smartphone to take a photo of each receipt as I pick it up, I will always have a record of my expenses. Since I use ” You Need a Budget” to keep track of our family’s expenses and plan for the future, it’s very helpful to keep all of these receipts in one place.

To be specific, I take pictures of my receipts using Evernote , which stores them in a note that I can easily access from my computer later. It stays there until I enter the information on “You need a budget.”

Hopefully, you can use at least one of these tips and do something useful with it that can help you cut costs the next time you go shopping or help you make better money decisions in the future. Good luck!

Eight Little Things to Always Remember When Shopping | Simple dollar