Not Applicants, Request Coronavirus Assistance Payment for Your Children Until Tomorrow

If you don’t usually file your tax returns, you don’t have enough time to request a $ 500 per child coronavirus assistance payment for your children.

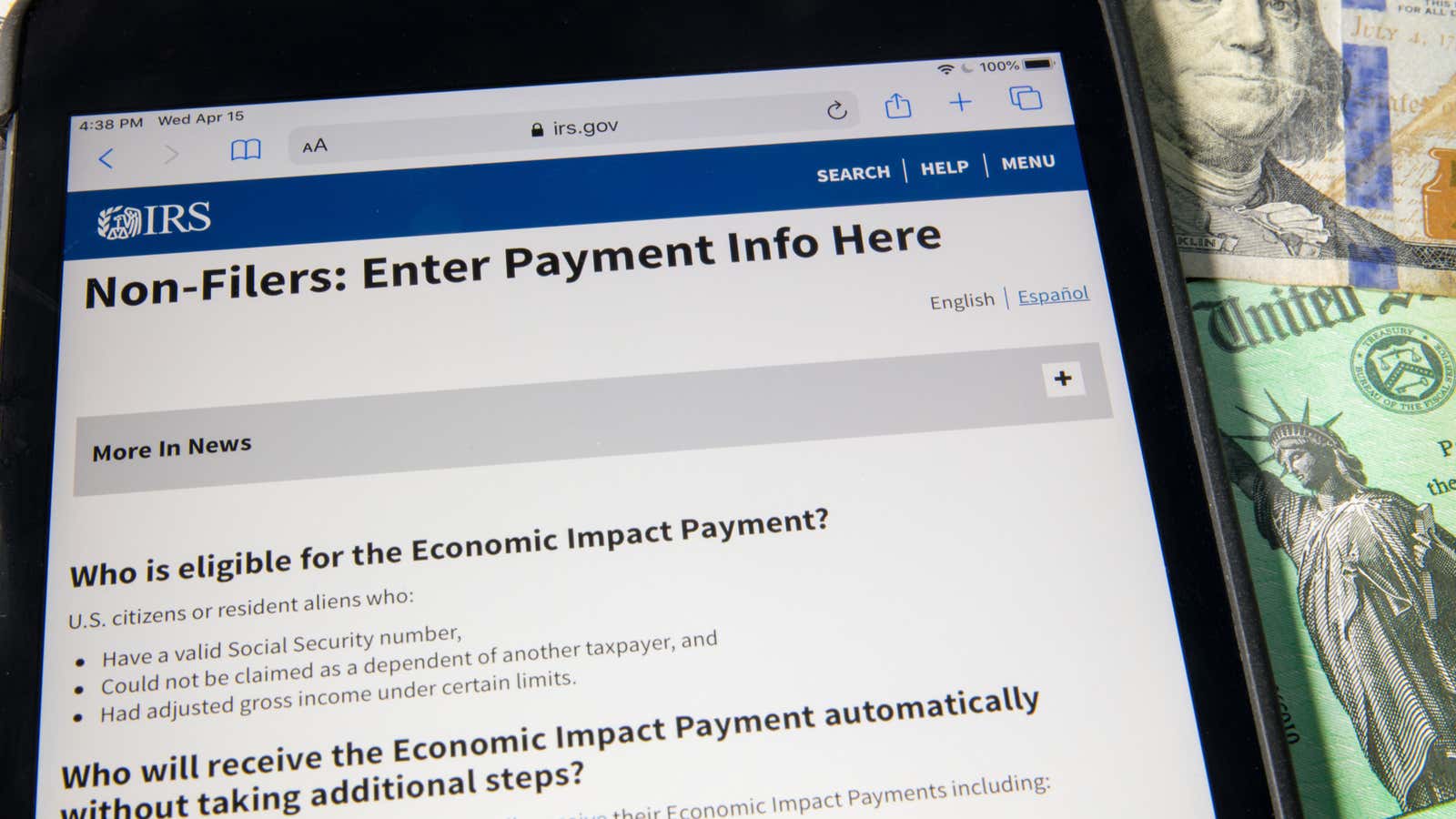

If you have not filed your 2018 or 2019 tax returns, the IRS wants you to use the non-filler tool by noon ET tomorrow, April 22nd , to notify the agency to add $ 500 per eligible child to your payment. in the amount of 1200 US dollars.

If you are receiving Social Security retirement benefits, survivor benefits or disabilities (SSDI), or railroad retirement benefits and you usually do not file your tax return , you should use the tool as soon as possible without filing to meet the 22 deadline April.

If you are receiving Supplemental Security Income (SSI) or Veterans’ Benefit, you will have additional time to notify the IRS of the children in your household using the no-document tool. The IRS says SSI recipients will receive their payments in early May, while the payment schedule for VA recipients has not been determined.

Keep in mind that if you usually file your tax return and have already applied for 2018 or 2019, you probably don’t need to do anything.

But if you are in one of the above groups and the IRS does not yet know about your children , you should act as soon as possible to notify the agency.

If you miss the deadline (or, for SSI / VA benefits, you do not notify the IRS before your check is printed), you will have to wait until the 2020 tax season starts in the spring of 2021 and you will then need to file your tax return to get a loan of $ 500 per child.