Track Your Spending With Microsoft’s New Money Excel Template

If you are tired of using third-party services to track your expenses – either because they are not as useful as you thought, or you are worried about giving third-party services access to your bank account and credit cards – you can now connect various financial accounts directly to Microsoft Excel. All you need is the new Microsoft Money template.

However, there are quite a few caveats that make installing Microsoft potentially less practical than services like Mint or YNAB . First, you have to pay Microsoft to use it. This shouldn’t matter much if you’re already using YNAB, but users of free financial services like Mint may not be thrilled with the idea.

Money in Excel is a premium template that you can download only if you have a family or personal Microsoft 365 subscription; Microsoft 365 Enterprise account users cannot participate. The cheapest Microsoft subscription plan, 365 Personal, will set you back $ 7 a month or $ 70 a year, which isn’t bad considering what you get (access to all Microsoft office apps), but still more expensive than free. And the idea of paying money to manage my money has always seemed strange to me, but it’s just me.

If you’re a Microsoft 365 subscriber, visit the Microsoft Money in Excel premium template website. There you will find two options: “Edit in Browser”, which launches the web version of Excel, and “Download”, which you can use in the Excel desktop or laptop application.

Once you run the template, you’ll get a crude landing page that explains the general meaning of a finance tracking spreadsheet, with a row of tabs at the bottom that you’ll want to navigate sequentially.

Before you start, make sure you click on the “Allow Editing” link at the top, which will show your usual Excel setup as well as “Do you trust this add-in?” sidebar tooltip. If you downloaded the file directly from Microsoft, select the option to trust the add-in.

You will then be prompted to sign in with a Microsoft 365 account (again) to make sure you cannot use this spreadsheet / add-on even if a friend sent it to you because this is how Microsoft works. Then you will need to connect your financial accounts to Excel – this is where Plaid can help you.

Naturally, the import did not work for me at all. Thank you, Capital One. (When I mentioned this to the queen of finance Lifehacker Lisa Rowan, she noted that this problem can occur with several different third-party financial services. A double thanks, Capital One. Get together.)

However, I had better luck with my credit card bills and was able to import information for multiple cards through my provider. Then all my transactions were showing up in my table like:

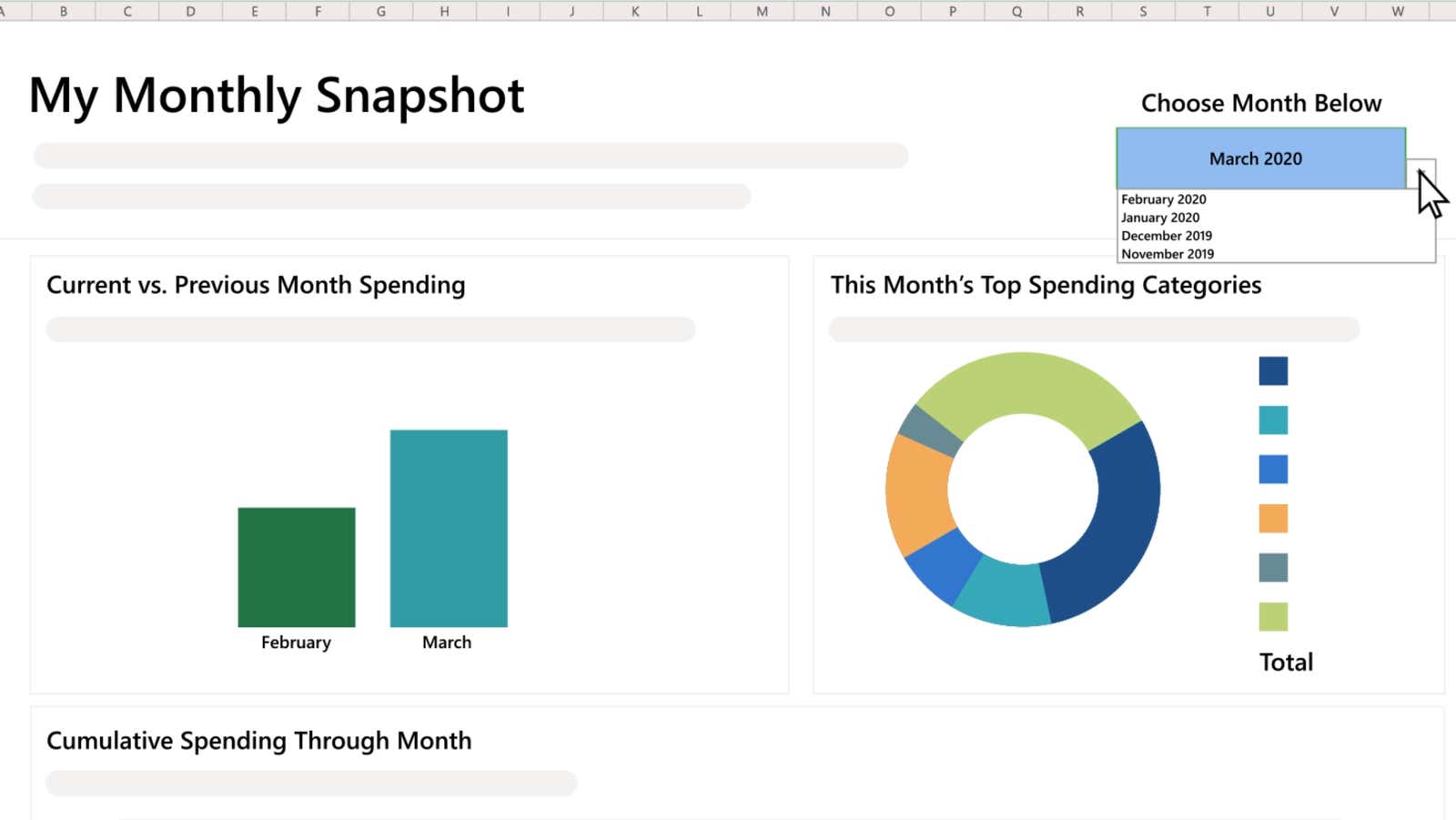

I was a little overwhelmed to see that the Snapshot tab in the spreadsheet was not working for some reason – apparently it had problems retrieving in the months of my transactions as there was nothing to choose from in the dropdown menu. I believe this chart is incredibly useful for getting a quick glance at your spending habits; I would really like this to work so that I can confirm that my daily Jamba juice habit is actually a financial risk. Hope you have better luck.

Microsoft also lets you add two additional templates to your spreadsheet if you need more information about your spending habits. You can quickly calculate all of your net worth across all of your accounts — useful if you’ve hooked everything up to Excel — and you can scan your spending on a recurring purchase flag in case your subscriptions go out of control.

While you can connect accounts to Excel that are not directly related to your spending, such as 401KB, Excel can do little with this data. You will see a popup with your account balance in the sidebar, but none of the tables use this information. This is a little different from other financial tracking services you may have used that can give you more metrics on the performance of your finances, regardless of type.

I have noticed that several people are complaining that they cannot connect multiple accounts from the same provider – for example, your account and your spouse’s account – through the Excel setup program. I haven’t been able to verify this myself as none of my friends lent me their bank account information for the day (sigh), but it’s worth considering before migrating your financial tracking to Excel.

Otherwise, if you are already a Microsoft 365 subscriber, there is no reason not to test setting up Microsoft Money for Excel. It’s not ideal – far from it – but I’ve always enjoyed working with a spreadsheet quietly rather than a web application. If your financial tracking needs are small, this may be all you need (plus a pivot table or two) to better control your spending and budgeting.

Oh yes it is; you will have to budget yourself in an Excel spreadsheet, as the Money add-in, oddly enough, does not include any budgeting tools. This seems like a glaring oversight to me, given that those who keep track of their finances will probably also like some way to ensure that their spending matches what they planned to spend in a particular month.

The budget shouldn’t be hard to tweak manually (if the Snapshot tab works), but if you’re not Excel-minded it can seem overwhelming. I’m sure Microsoft will add this feature as it adds new features to Money, but it’s not there yet – and it’s the same thing I think of the Money template in general. This is useful, but not good enough for handling large analysis and tracking outside of the framework.