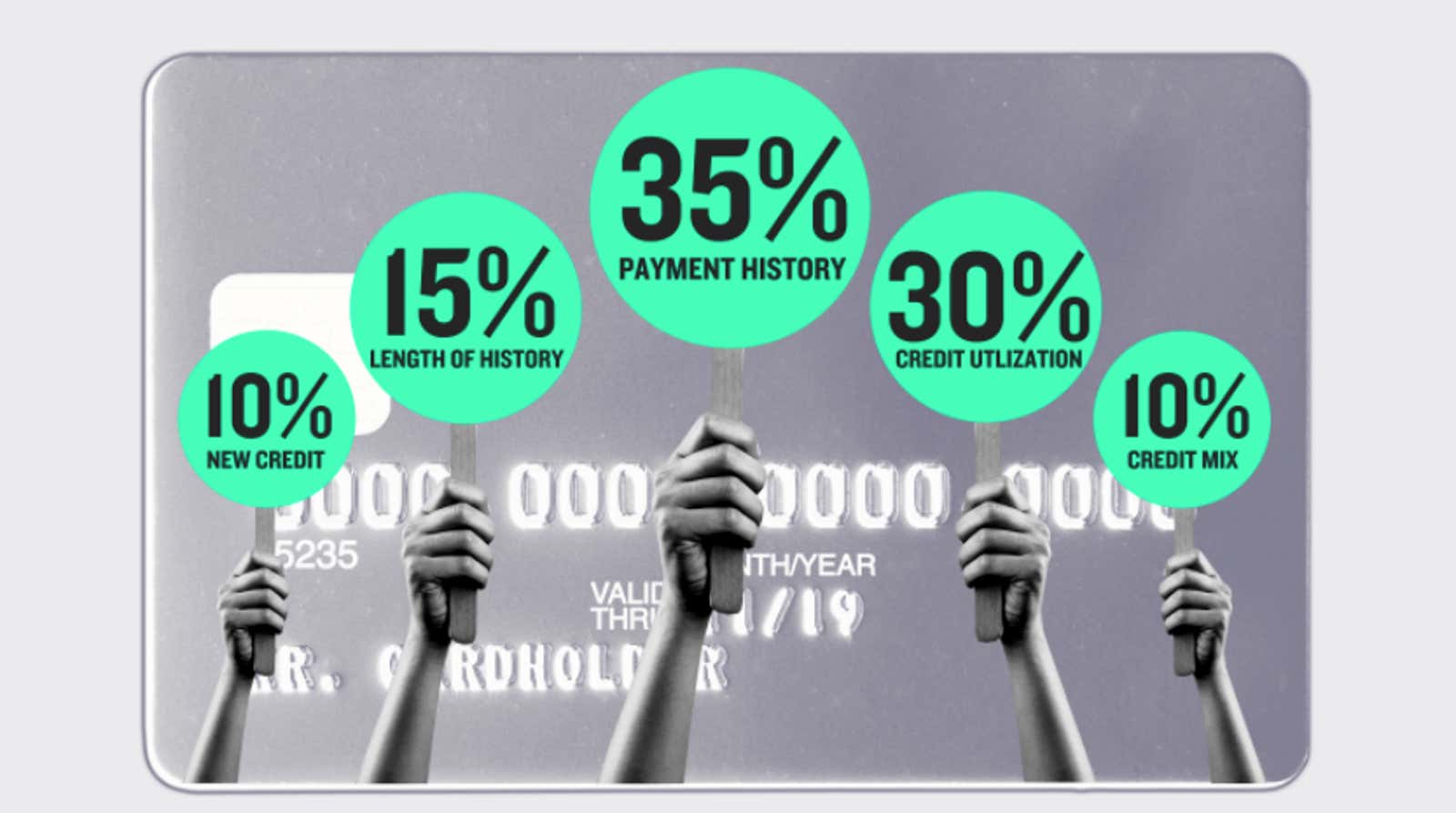

How Your Credit Rating Is Determined

When most people talk about credit ratings, they mean your overall FICO rating – the one lenders are most likely to use. FICO is silent about the formulas they use to calculate our grades, but we do know the general categories they track and how important they are to that calculation. Here are the categories and what you need to know about them.

Payment history accounts for 35% of your bill

Your payment history makes up 35% of your bill, and that’s pretty much what it looks like: your history of paying off debt in full and on time. According to the FICO, this story is a good indicator of how well you are managing debt in general. According to CreditCards.com , your payment history is based on seven main factors:

Payment information for various types of accounts, including credit cards, retail accounts, installment loans, and mortgages.

Any adverse public records such as bankruptcies, court decisions, claims and liens, and foreclosures and delinquencies.

How long are the payments late.

The amount of money remaining due on overdue invoices or collection items.

How long has elapsed since any wrongdoing, adverse public record, or collectibles occurred.

The number of overdue items listed on the credit report.

How many accounts are paid by agreement.

The FICO determines all of this by analyzing your credit report (which is why your report is much more important than your rating ). It is not easy to know when a late payment will show up and affect your account as there is no set rule for when creditors must report late payments. Some may not report a missed payment for 60 days, while others report it after 30 days. You can always check your credit report to make sure there are no outstanding payments, but generally, if you have a history of timely payments, you should be clear.

Credit use is 30% of your grade

Credit use is the amount of credit available to you , which you actually use . This percentage – the available loan to the loan used – is called the loan utilization ratio. For example, buying $ 1,000 with a $ 10,000 line of credit gives you a 10% loan utilization rate. The lower the utilization rate, the better your score ( with the exception of 0%, because it does not give lenders the opportunity to thoroughly study credit history), and experts say the ratio should not exceed 30%.

Since your credit limit is part of the credit utilization equation, closing your old credit card can sometimes work against your FICO score. However, people still choose to close their old cards and suffer losses rather than paying an annual fee for a card they don’t even use. However, it is best to avoid canceling credit cards just before applying for a mortgage or any other line of credit.

Some loan officers offer to open multiple cards to boost your score . While it sounds counterintuitive and risky (tempting to spend!), Raising your total credit limit does increase your FICO rating due to the use of credit. Just remember that good financial habits are more important than your credit rating.

Some people will tell you that maintaining a balance is important to create credit, but experts agree: this is a myth . Credit card analyst Janine Skowronski put it best on Forbes:

“It’s absolutely certain that you don’t need to have a balance,” says Skrowronski, who recommends paying your credit card on time and in full every month. The only thing you do when you have a balance is to pay interest – and with an average national interest rate of 15%, which can add up quickly.

The length of your credit history is 15% of your rating

The length of your credit history doesn’t make up a large part of your score, but it does matter. According to CreditCards.com, this is “the length of time each account was opened and the length of time since the last time the account was accessed.” There are three main factors that affect the length of your history:

- How long have your accounts been open in general.

- How long certain types of accounts have been opened.

- How long has it been since you actually used these accounts.

This factor makes it impossible to get an ideal credit rating if you are new to lending, as you need to report at least six months on your report to start building your story. FICO wants to see a long history of loan use so they can assess your long term financial habits.

New loans and loan mix are 10% each

New loans and a combination of loans are two different factors. With the new loan, FICO is looking at several different things:

- How many new accounts have you opened in the last 6-12 months : “If you manage your loan in a short time, do not open many new accounts too quickly. New accounts will lower the average age of your account, which will have a greater impact on your FICO scores if you don’t have a lot of other credit information. Even if you have used the loan for a long time, opening a new account can still lower your FICO scores, ”says FICO.

- Recent Requests : A request is when a lender retrieves your report to check it. However, this will not greatly affect your rating, and after two years the activity usually disappears from your report. In addition, FICO only reviews requests from the last year.

- How long has it been since you opened a new account: According to the FICO, your score “may take into account the time elapsed since you opened a new credit account for certain types of accounts.”

- How well have you recovered from past payment problems: “Delayed payment behavior in the past can be overcome; credit recovery and timely payment will increase the FICO rating over time. ”

The credit mix is rather vague, but it essentially means that the history of the various types of debt is useful in your assessment. FICO argues that borrowers with a good range of credit cards – cards, car loans, mortgages, student loans – generally carry less risk for lenders. FICO says:

“The credit mix will usually not be a key factor in determining your FICO scores, but it will be more important if your credit report does not contain a lot of other information on which to base your score.”

While other credit ratings exist, most lenders rely on FICO, and even if they don’t, scoring models will use similar factors. Tracking your FICO rating should give you a good estimate of your overall creditworthiness.

This story was first published in 2017 and has been updated on October 22, 2020 with more recent information.