When to Skip Your Company’s 401(K)

401(k), the most common way Americans save money for retirement, has been around for a little over four decades. Established by the Revenue Act of 1978, 401(k) became a way to defer tax-free compensation beginning in January 1980. Since then, retirement has never been the same, for better or worse.

Today, participation in 401(k) plans is almost automatic for anyone working for a corporation. This is the main way to save money for your golden years (since pensions are becoming rarer outside of certain areas of the public sector), and if there is a match with a company (meaning your employer also deposits money into your account), it’s free money – why not No? do you want to use it?

But not all 401(k) plans are created equal, and blindly participating in one just because it’s not always the best course of action. If you’ve been invited to a 401(k) plan, here’s what you need to look at to determine if it’s the right decision.

Fees are high

Many people are surprised to find that a 401(k) can include a lot of fees. Most of them are perfectly legal, according to Mark Weber, tax director of CliftonLarsonAllen , a certified public accountant and financial advisor. “A typical plan will include a few mandatory costs,” he notes. “The direct cost of investment, the cost of an accountant ([who] keeps records for all participants so that they can determine the value of their accounts), and the cost of the platform. A 401K provider may pay a commission to a sales representative, but it must come from their commission and not from investment income.”

In addition, most 401(k) plans must offer investor education (those annual or biennial seminars that many employees attend to learn about their investments and other plan options) and adhere to a variety of compliance rules, all of which must be paid for. . In other words, 401(k) can be a costly benefit.

How to know when a 401(k) fee is too high

So how high are the 401(k) fees ? A good rule of thumb is to add up all the fees listed on your statements or on the plan’s website. If they are more than 1.5% , investing in a plan may not be the right move.

Another thing to look out for when evaluating the fees of a 401(k) plan is what is known as income sharing . Most 401(k) plans pay the required administrative fees directly, which are transparently deducted from your account. Income sharing is a form of indirect payment paid out of an investment in a plan, which makes it much harder to quantify —and it grows with your account size, meaning it can become a big waste of your retirement savings over time.

The plan does not offer flexibility

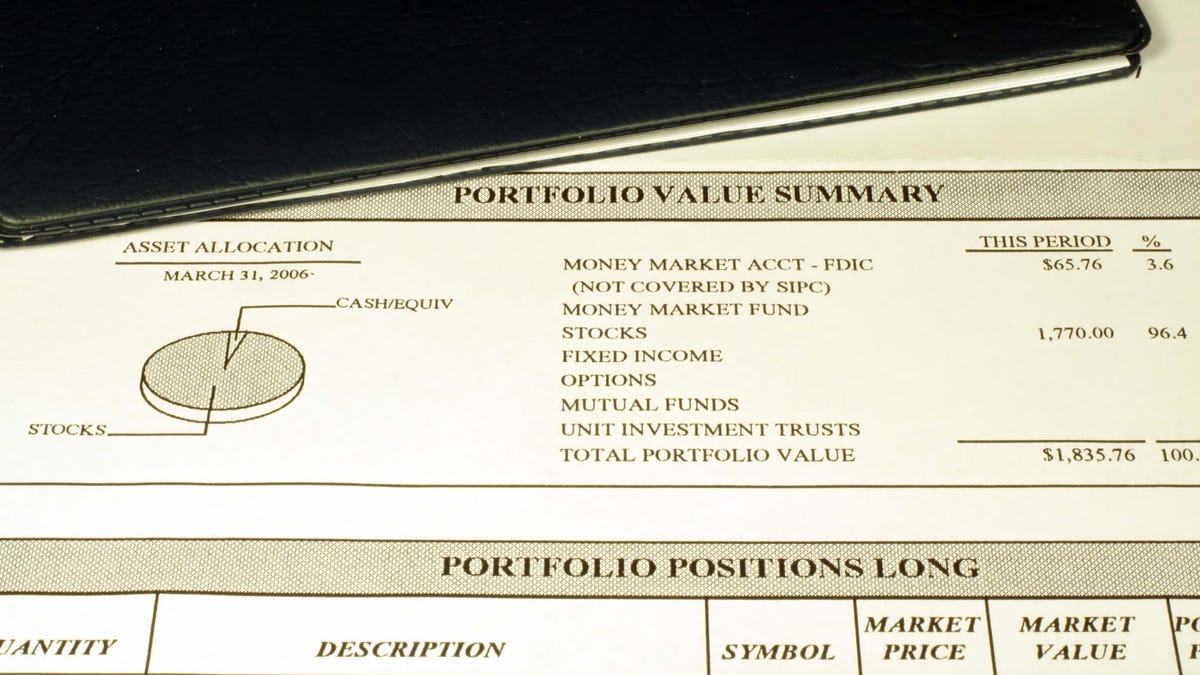

A 401(k) plan puts your tax-deferred money into a range of investments, and the more options you have, the better. “You have to look at fund selection to determine if there is an adequate choice in terms of asset allocation and value,” Weber notes. “A good 401k will have a selection of equity funds spanning many asset classes (large cap, mid cap, small cap, international, emerging markets, etc.) as well as fixed income (government bonds, corporate bonds, emerging market bonds, etc.) d.). .). The plan will typically also have a choice of money market type and possibly some age funds – such as the 2030 pension fund.”

Most 401(k) plans are quite limited in the investment options they offer. The more options, the better, but on average there are about a dozen options . If your employer’s plan has only a few investment options (maybe only three), it might not be worth your time.

Compliance of the company is not very

Employer consent is one of the most valuable aspects of a typical 401(k) plan. The specifics of the Employer Matching Formula vary from plan to plan, but they are usually expressed as a percentage of your annual income and your personal contribution. For example, your employer may offer a 100% match up to 6% of your salary, meaning if you contribute 6% to your 401(k), your employer will match that amount. These formulas can range from very generous to very ungenerous , but no matter how big or small the amount offered, if you’re going to be in the plan, you should get it because it’s free money.

If your employer offers little or no compliance, it doesn’t automatically mean your 401(k) isn’t worth investing in, but it’s an important factor to consider. If there are no matches and there are other issues – high fees, few investment options – it may indicate that this particular plan is not worth participating.

There are long delays or vesting schedules

The last two aspects of your 401(k) plan to pay attention to are eligibility and vesting periods. If your employer is trumpeting a 401(k) but you are not eligible for an unreasonable amount of time—a year or more—this is a sign that you may need to take your retirement savings into your own hands, at the very least. temporarily.

Another thing to pay attention to is the length of the vesting period. When an employer matches your 401(k) contributions, that matching money doesn’t immediately become yours. There is usually an vesting schedule that progressively gives you full ownership of these funds, usually tied to the length of your employment. Typical vesting periods can be anywhere from 2 to 4 years, meaning that if you leave the company before you’ve been there even that much, you won’t keep the company eligible.

Obviously, a 401(k) plan with no vesting period at all—meaning all your money from day one—is the best. But if there is a vesting period, make sure it is not unreasonably long.

Your company’s 401(k) alternatives

So what can you do if your employer offers you a 401(k) that doesn’t look like a good investment? The good news is that you have several options.

“If you decide the plan isn’t attractive because it might have a poor investment choice, high cost, or lack of employer fit, you might want to consider saving yourself,” Weber suggests. “It can be done through an IRA or a Roth IRA. A traditional IRA may not be taxable depending on a variety of factors. If not, you can always contribute on a non-deductible basis.”

Keep in mind that you can contribute much more to a 401(k) than to an IRA; limits for 2023 are $22,500 and $6,500 respectively (there may be different limits depending on your age and other circumstances), so even a mediocre 401(k) might be a better choice. But if your 401(k) really stinks, an IRA might be the best long-term choice.