A Beginner’s Guide to Good Investment

The impact of the investment has already been withdrawn , and this is not surprising: while people want to keep track of their money growing in the market, they don’t want to hide their money with corporations they don’t like.

A recent study found that 78 percent of millennial investors have either invested their money in these types of investments or plan to do so in the future. This may be because with impulse investing you can actually support the things that matter to you .

“Impact investing has unique potential to harness the immense power of investment capital to address many of the world’s most pressing social and environmental challenges,” said Hannah Schiff, research manager at the Global Impact Investing Network (GIIN), a nonprofit working with scale up and the effectiveness of impact investing.

What is Impact Investing?

Before diving into impact investing, let’s first look at the generic term socially responsible investment (SRI).

According to Investopedia, SRI is an investment that takes into account the “nature of the business the company does”. Basically, it means investing with your ethics in mind, whether it’s quitting the tobacco or oil companies or finding companies with a social or environmental mission.

While definitions of R&D-related terms differ depending on who you speak to – and are often used interchangeably – at a minimum, socially responsible investing usually involves “negative screening” or filtering of industries such as tobacco, firearms, gambling. games, etc.

The next step is environmental, social, corporate investing (ESG), which ensures that companies meet a set of specific criteria, such as fair treatment of employees and environmentally sound working practices.

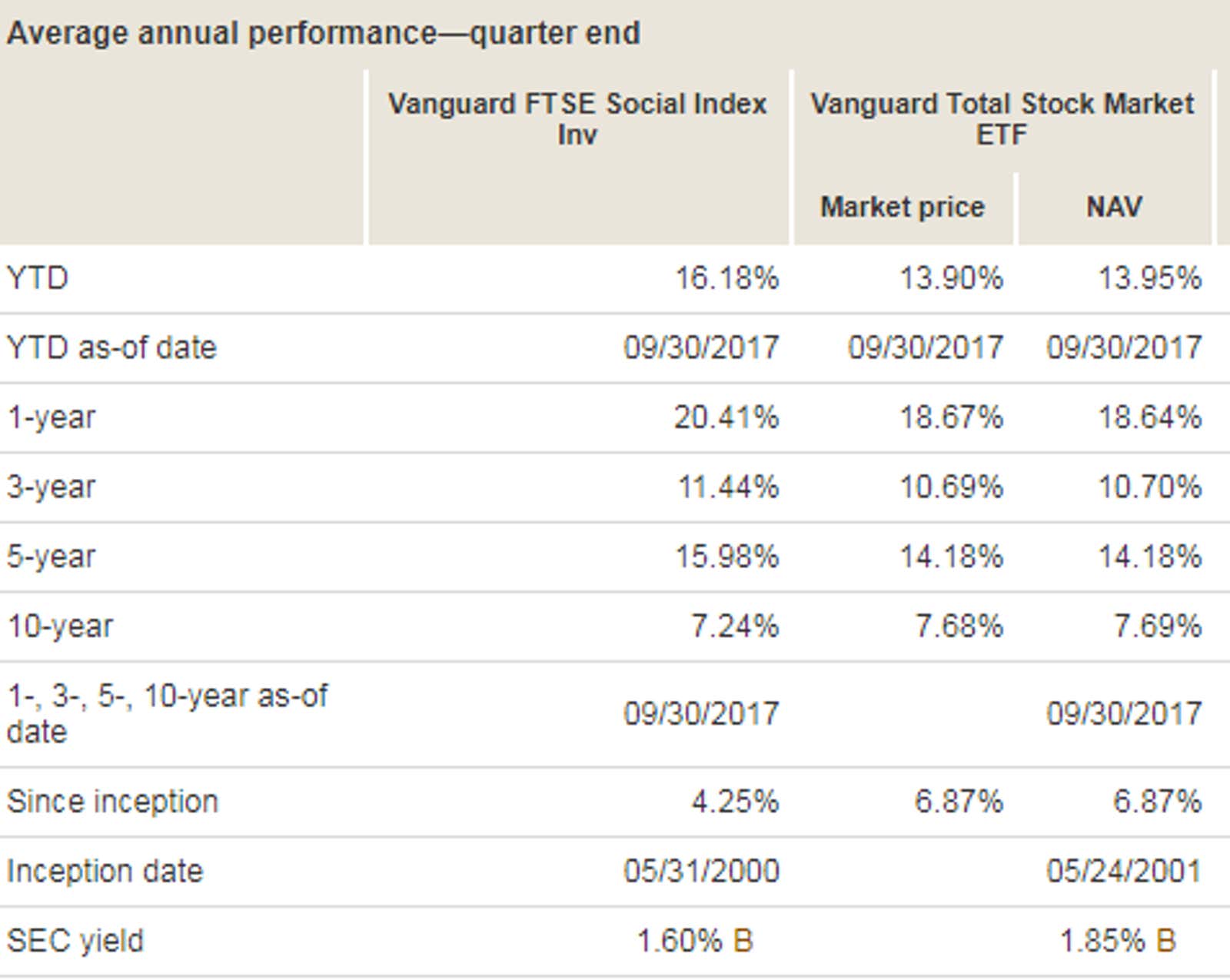

When it comes to this type of investment, many companies have taken the train. Betterment offers a portfolio of socially responsible investing (SRI) ; Wealthfront allows companies to be excluded from fossil fuels, deforestation, weapons and tobacco; Stash has ETF Do the Right Thing ; Wealthsimple offers a selection of socially responsible ETFs . Even the high-profile investment firm Vanguard offers a social index fund that “seeks to track benchmarks for large and mid-cap stocks that have been verified against specific social, human rights and environmental criteria.”

The most rigorous type of SRI is impulse investing, which targets companies working to solve social or environmental problems. When you make an effective investment, you can pinpoint the reasons you want to support and the companies that focus on those reasons. For example, with an investment fund, you can invest in Tesla, which makes electric cars , or Xylem, which designs pumps that save both energy and water.

Or, as one impact investing firm explained : “Where socially responsible investment fund managers tend to be passive and take a ‘do no harm’ approach, investment funds typically not only seek to have a positive impact, but measure and report their impact. in a transparent form. way.”

Return on investment impact

While many investors fear that successful investments will lead to lower returns, history has shown that this is not always the case. In terms of broad investment in SRI, some cite the MSCI KLD 400 Social Index , which targets companies with high ESG ratings. Created in 1990, it was one of the first SRI funds and has had an annualized return of 9.89 percent since 1994. This compares to the historical average of the S&P 500 ( 9.8 %).

In terms of impact in particular, a 2015 study by GIIN and Cambridge Associates analyzed the “benchmark” of 51 impact investment funds. It found that their net internal rate of return (IRR) was 6.9 percent, while the “comparative population” of 705 private investments brought in 8.1 percent.

However, he noted that “most of the results in recent years remain unrealized.” And when you look at the small group of funds launched between 1998 and 2001 (which were mostly realized), impact investments outperformed the comparable figures by 15.6–5.5 percent.

While the data is promising, it is limited: the 51 funds in the exposure benchmark had $ 6.4 billion in assets, a small fraction of the $ 293 billion held by 705 funds in the comparative total.

Where to begin

You can of course choose the companies yourself, investing individually in those that support your chosen goals. However, there are also tools to make this process easier, including ImpactBase , a searchable GIIN database of over 400 hit investing tools.

To play it safe , you can build a virtual portfolio of influencers using a tool like MarketWatch Mockfolio to experiment with potential options and see how they perform over time. Or, for a more automated approach, you can explore platforms such as:

- Motivating Investing: Choose an investment portfolio focused on a sustainable planet, fair work, or good corporate behavior. Since launch in March 2017, portfolio returns have been 5.16%, 7.51% and 7.13%, respectively. The minimum investment is $ 1,000 and the cost is $ 9.95 per month.

- OpenInvest: With $ 3,000, you can invest in values like LGBT rights, women leaders, or opposition to President Trump. The annual commission is 0.50% of assets. On the bottom line, Co-Founder and Chief Strategy Officer Joshua Levin said, “Our client portfolios are highly individualized and each is slightly different. But since we are only engaged in passive investing, by design, all our portfolios operate within 1-2% of the market. Historically, they have acted as such. “

The lowest barrier to entry is through Swell , which has a $ 50 minimum investment and a 0.75 percent annual maintenance fee. The platform allows you to choose what percentage of the money you want to spread across six different portfolios: green technologies, renewable energies, zero waste, clean water, healthy lifestyles, and disease eradication. Each portfolio contains approximately 50-60 companies that are earning income from their chosen goal and have the potential to generate financial returns.

Over the past year, Swell’s portfolio of green technologies has performed the best of six, growing more than 30 percent. “It became clear that you can invest with your values in mind,” said founder and CEO Dave Fanger.

Even if you’re not ready to take the plunge yet, those involved in impact investing are encouraging you to ask questions.

“At the very least, study where your money is currently being invested,” said GIIN’s Schiff. “Are you satisfied with the companies that support your funds?”