What Is an Economic Impact Payment Card?

If direct payments return to the table during the latest emergency relief bill negotiations, it is possible that Americans will see cash payments in early 2021. However, millions of these payments will be sent in the form of an EIP debit card, which, as we saw in June confused many, some of them threw their cards away. Here’s how to avoid it next time.

What is an EIP card?

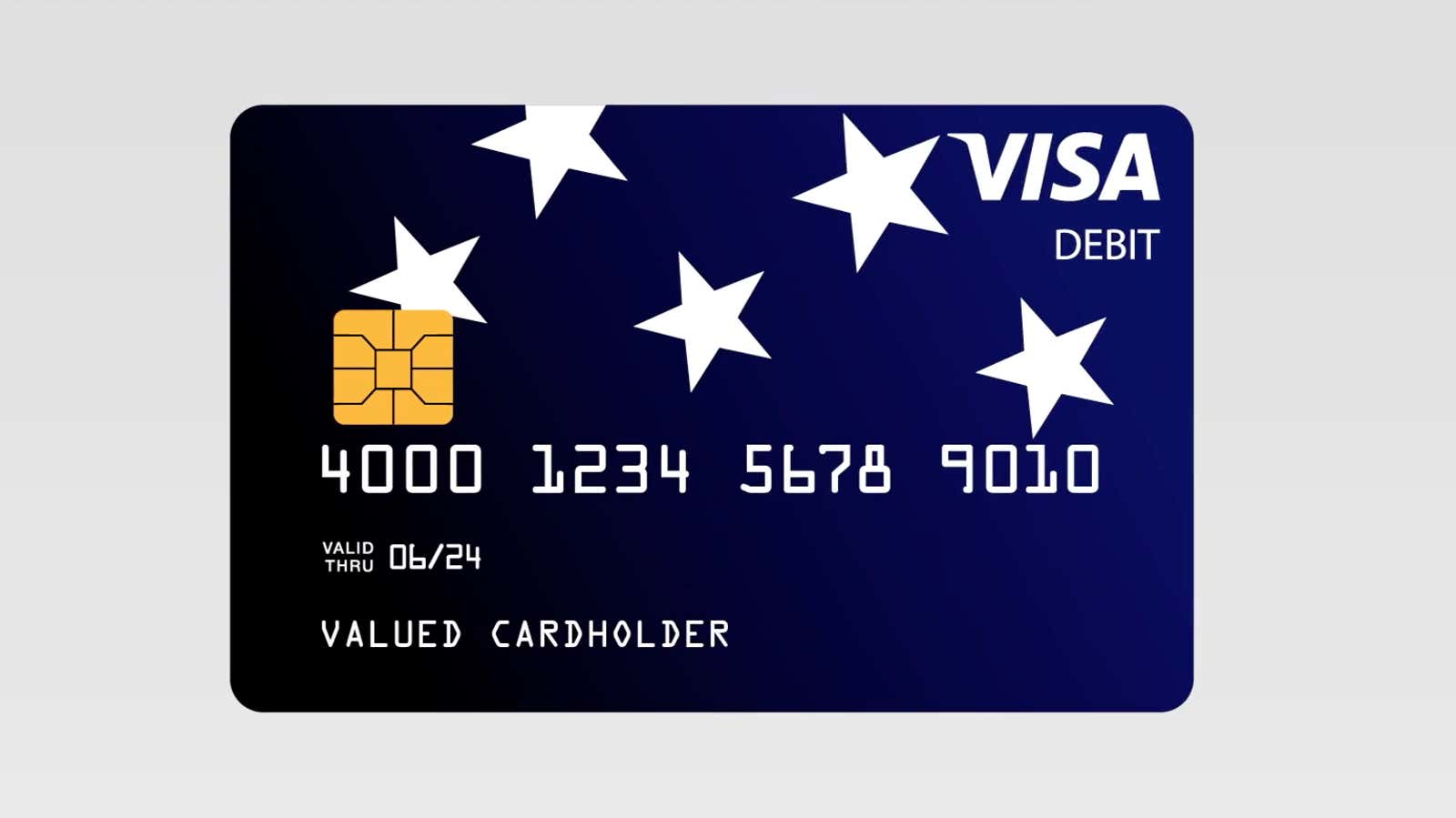

It is not yet clear what the cash amount might be for the second aid payment, but qualified recipients will receive aid payments by check, direct deposit (more on that later), or in the form of an Economic Impact Card (EIP), which is a prepaid Visa debit card issued by the Ministry finance. These Visa debit cards will be sent to the address you last filed as part of your tax return with the IRS and can be used for debit purchases, cash withdrawals from participating ATMs, or to transfer money to your personal bank account (remember this is prepaid a debit card that is pre-loaded by the government, so it has nothing to do with your personal bank account).

One of the benefits of these prepaid cards is that they reach the 25% of Americans who do not have access to banking services and are likely in need of cash the most. Unfortunately, qualified recipients did not notice these cards in the mail, unnecessarily delaying their payments.

Don’t miss your EIP card in the mail

As a security measure, previously prepaid debit cards were sent in plain, unassuming envelopes to protect themselves from thieves, but this also led to some confusion for many people as it looked like spam. While it is unknown if it will be the same in the second round of checks, look for “Services for Money Network Cardholders” in the return address on the envelope as it could be your card. You will be sent a card along with important information, activation instructions, fees, and a note from the US Treasury.

What if you still lose your EIP card in the mail?

While we are talking about the proposed aid payments, it is not expected that the policy regarding EIP cards, such as replacement, will not change. Currently, if you lose or destroy your first card, you can obtain a replacement card by calling the IRS at 800-240-8100 (select the second option from the main menu). The first card replacement fee will be canceled and you will be charged $ 7.50.

For more information on EIP cards, visit EIPcard.com ‘s FAQ page to get answers to common questions, and use their ATM finder tool to find ATMs that don’t charge a fee.

Want to avoid regular mail? Try direct deposit

If you received your EIP card for the first time, it is very likely that you will receive it for a second direct payment. However, you can avoid the risks of mail fraud by registering with the IRS for a direct deposit into your bank account.

It’s not clear yet if the IRS will use the Get My Payment or Non-Filers: Enter Payment Info tools used for first checks, but you can register here for a direct deposit with the IRS as part of your tax return early next year.