A Beginner’s Guide to Checks

Checks: they are like the 20th century, but they still hover in our lives. And sometimes they are absolutely necessary.

If your skills in writing checks (or receiving checks) are outdated, here’s everything you need to know for proper and safe banking. Because even if you have Venmo, Cash App, PayPal, Zelle, and Apple Pay (we could go on …), at some point you still have to deal with one or two checks.

How to write a check

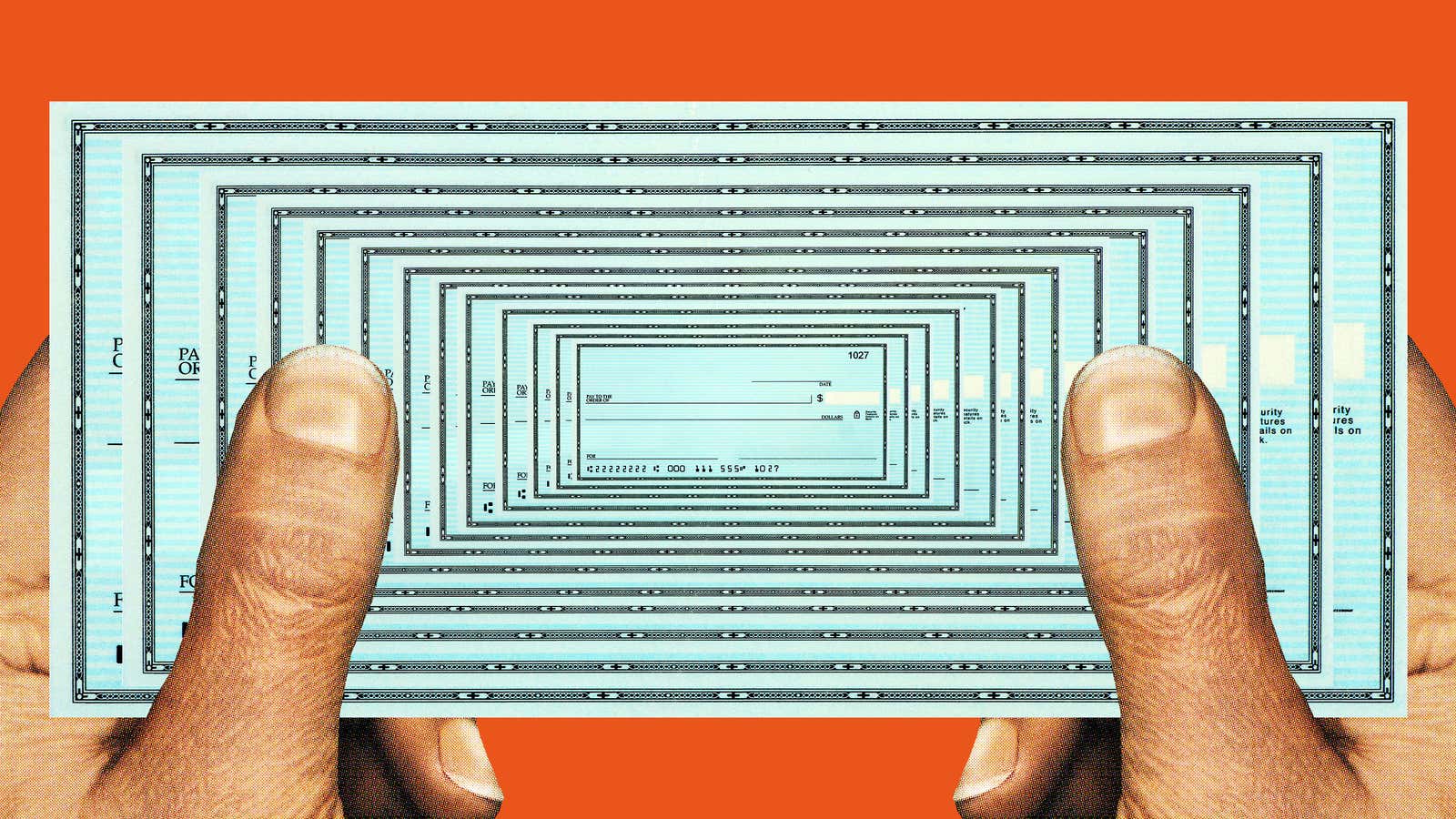

If you have little experience in the check writing department, here’s how to write them like a pro. Take a look at the corresponding numbers in this handy chart to see what is going where (and why).

- Your name and address.

- Date.

- The recipient is the name of the person or company you are giving money to.

- Sum in numbers. This place is called the dollar box.

- And again the amount. This time, you will write it down in words. Be sure to fill in the entire line so that no one can change the amount. For example, don’t write “four dollars” in narrow letters in the first half of a line, and don’t call it a day. Write “Four dollars and zero cents ————-” or “Four dollars ————— xx / 100” to fill in the entire line.

- The name and contact information of your bank.

- Memo line. You can write your account or account number here, or make a note like “a gift for Janet”.

- Your signature. If you write a check but forget to sign it, that’s bad news – your recipient won’t be able to deposit money.

- Routing number for the current account. Your routing number matches the bank where you keep your account.

- Current account number.

- Check number. It is located in two places: below, next to the account number, and in the upper right corner. Each check in your checkbook has a number that was once needed to keep track of and balance your checkbook. It’s nice to go in order these days, but if you don’t, that’s not a problem.

- Fractional bank routing number. Written in a special format.

- Now we are on the back of the check (this can be seen in the picture below). This is where you sign the check or give it to someone else to deposit or cash out. Don’t write below the line!

- Security zone. Consumers don’t use this area — banks use it to authenticate checks.

How to get a check

When you receive your check (thanks, grandma!), You will need to sign it. You do this by signing your name (which must match your ID and how the issuing checker wrote your name) in the # 13 area on the back of the check. Stay in the specified location as the remainder of the check is reserved for bank use only.

In this area, you should also provide other required information or instructions. If you would like to deposit a check using your phone or ATM, you will probably sign your name and write “for deposit only” in the confirmation area. In the meantime, if you deposit a check into a checking or savings account at a bank branch, you will most likely need to include the account number above or below your signature.

Then it’s time to post the bond or cash the check. Make sure you have your debit card or account information and take note of how soon your funds will be available. If you are depositing a check via a mobile phone, you should keep it for two weeks to ensure that the payment went through correctly.

As you probably know, banks are not the only place to cash a check: large grocery stores usually offer check cashing services, as do the aptly named check cashing centers. But if you’re not at your bank, you may end up paying a fee of about $ 5 to cashing checks, depending on the amount of the check.

Answers to your weird security questions

Can I postpone a check to force the recipient to postpone the check?

If you pay your rent by check, you know this trick: you write your check on the 25th or 26th and stick it in the mail, but put the first of the month on the check so that the landlord can’t cash it out before you get paid.

While your recipient and some banks may pay the due date check, there is no guarantee that they will, and there is nothing stopping them from cashing that check anyway. Therefore, if you want the recipient to wait before depositing the check, you must make it clear to them.

I’m writing a check for a wedding gift. What should I do with these names?

Do not assume that someone is changing their name, and do not assume that a couple has a joint account. Write a check for “Legal Name One OR Legal Name Two” so that either party can post the bond.

What does it mean to sign someone else’s check?

When you receive your check, you can ask someone to get the money and use it. One reason may be that someone else is managing your money for you.

To do this, you must first ask a third-party check at his bank to find out if he will honor signed checks. If the bank allows, they will give you instructions on how to do it right. You may be prompted to write “Pay for [Person’s] Order” and sign the check, or you may be prompted to simply ask a third party to sign below where you confirm the check.

Remember, all of this must be placed in this approval box, so don’t go crazy with the intricate handwriting.

What is a counter or starting check?

When you open a bank account, your bank provides starter checks as it takes a minute to print checks with your personal information. Not everyone accepts starting checks, so ask them before writing.

Counter checks are checks that your bank can print if you need to write a check but don’t have it on hand. Usually there is a multi-dollar charge for this convenience.

What is a cashier’s check and why do I need it?

The cashier’s check is printed by your bank and the payee’s information is printed on it. This type of check ensures that the funds are ready for payment – as if your bank had affixed an approval seal to your payment. You may need it if you are making a large payment, such as a rent bond.

How about the checks your credit card sends you to transfer the balance?

Card issuers send you blank checks when they mail you balance transfer offers so you can easily access the funds they provide you through said transfer offer. For example, you can write one of these checks to pay off another debt, essentially transferring the debt to a credit card that offers you a balance transfer.

Balance transfer offers can be a great way to pay off debt quickly, but checks can be confusing. Avoid using them if possible.

My checks are old and do not match my current address. Can I use them?

You can still use old checks if your account information (route and account numbers) is still correct. You can cross out the old address and write your new one for the recipient’s link. (Some companies may ask you for an ID to verify this.)

Where can I order new checks that won’t cost a billion dollars?

Banks love to charge the highest fees for checks – we’re talking at least $ 25-30 per box. But you don’t need to order checks directly from your bank: various services offer basic checks at basic prices – check Vistaprint, Checks.com, or even Walmart for budget options.

The year 2020 is coming. Are paper checks even safe now?

As with any other form of payment, the security of using a check is up to you. To prevent checks from being intercepted , take them to the post office for mailing instead of putting them in your home mailbox for receipt. Do not carry your checkbook with you to avoid losing or stealing.

And, as always, be on the lookout for verification scams . If someone asks you to cash a check for more than the amount owed to you, do not do so – most likely you have a scammer in your hands.