Is the Apple Card Worth It?

This spring, it announced a new Apple credit card called the Apple Card, which is not yet available to everyone – the card began issuing this week. While a select few (a random set of people on the waiting list) start using the card, let’s see how it stacks up against your other options. Yes, Apple Card is futuristic and weird, but should you send other cards to the back of your wallet?

What’s good about Apple Card

Application process

- It takes a few minutes to apply for a card. You can see your interest rate and credit limit before accepting the card, and Apple says your credit score won’t change until you accept the card.

- You can use the card on your iOS device wherever Apple Pay is accepted. Once approved, you can start using Apple Card right away in the Wallet app.

Billing and rewards

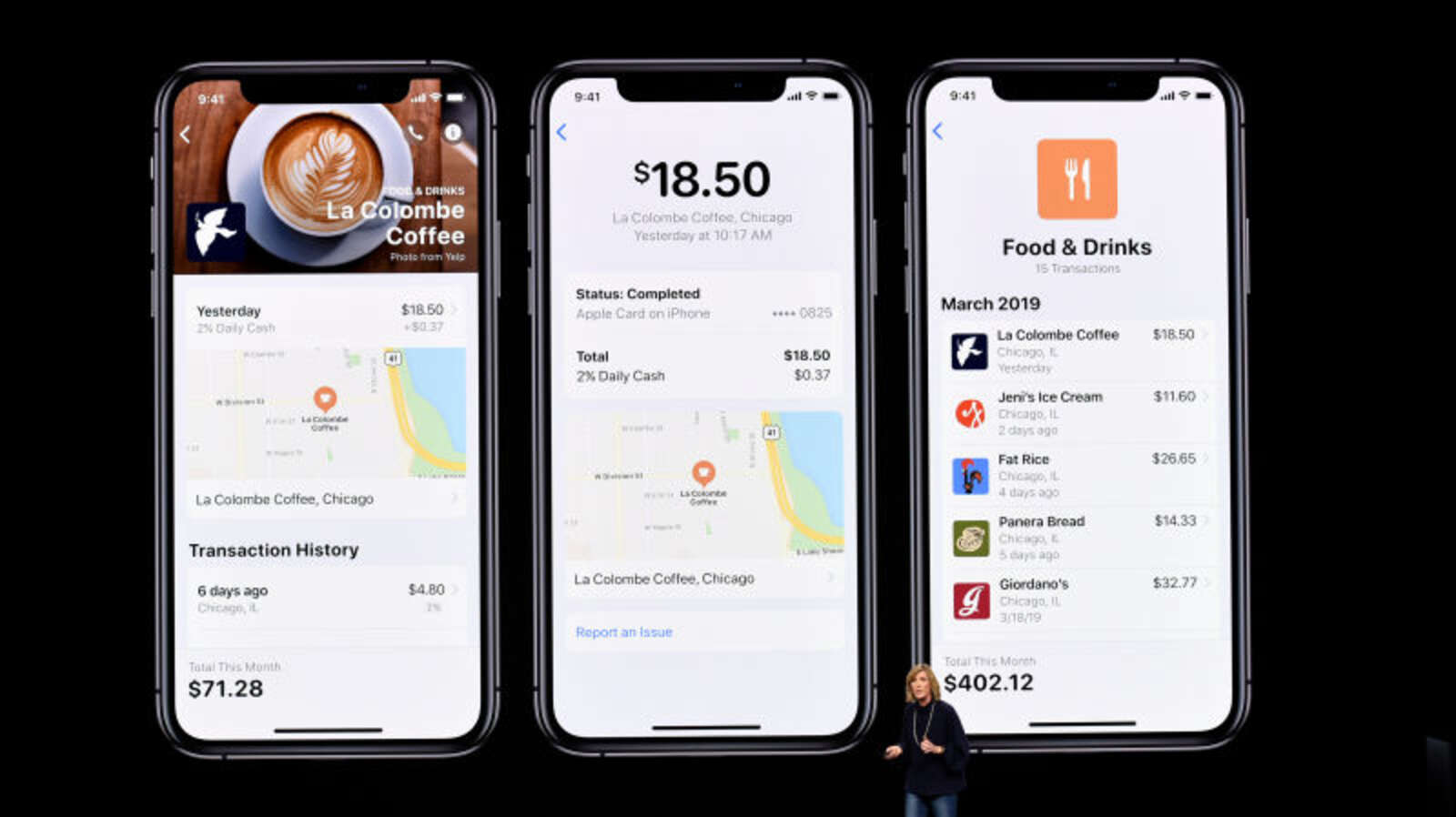

- The card automatically categorizes and colors your spending by purchase type in the Wallet app. It also displays your purchases so you can see the physical areas where you made payments. You can view a summary of your spending by week, month, day, or expense category.

- You get 3% cashback on purchases made at Apple, including games or subscriptions such as Apple Music. You earn 2% when you spend using Apple Pay and 1% on all other purchases. This cashback is provided on a daily basis, instead of forcing you to wait for the end of a billing cycle to see the benefits. You can choose whether you send this money back to the card to reduce your balance, pay a friend via iMessage, or send it to your bank account.

- There is no limit to the amount of cashback you can earn, but you must have an Apple Cash card in the Wallet app to be able to receive daily deposits.

- If you do not pay the entire bill, you can see the approximate amount of interest you will pay based on the amount paid.

- Apple Card does not charge an annual fee. There are also no late fees, cash withdrawal fees, international transaction fees, over-limit fees, or refund fees.

- Just nice to watch! The physical map is impressive and is the dream of a fan of minimalistic design. And as David Murphy , senior technical editor at Lifehacker pointed out, the virtual card color in your Apple Wallet changes to reflect your spending categories.

Security and privacy

- Fraudulent payments can be flagged through Apple Wallet, and Apple says you can have your questions answered “24/7 by text messages,” instead of calling them.

- Apple Card requires Face ID or Touch ID to authorize purchases and associates a one-time security code with your device number for each purchase. There are no numbers or security code on the physical card – just your name. Your Wallet app stores a virtual card number that you can use to shop online at websites that don’t have Apple Pay.

- Apple states that the Goldman Sachs card administrator will “use your data to work with the Apple Card,” but clearly states, “They will never share or sell your data to third parties for marketing or advertising.”

What’s Not So Exciting About Apple Card

Interest and awards

- Your variable interest rate depends on your credit history and can range from 12.99% to 23.99%. It is competitive with other credit cards, but if you are looking for a minimum interest rate, you might be better off going to a credit union.

- If you are not deeply rooted in the Apple universe and do not know that you will receive that 3% cashback often, you can get higher rewards on other cards. For example, the Chase Freedom card offers 3% cashback on all purchases (for your first $ 20,000 spending), while the Discover It card offers an alternating quarterly cashback category of 5%.

- At this point, your map activity won’t sync with budgeting apps that you might be loyal to.

Apple ecosystem

- Obviously, this map is only useful for iOS users. You must have a compatible iPhone model with Face ID or Touch ID and the latest version of iOS. iPhone 5s dropped.

- If you’re trying to spend less time on your phone, this might not be the best option for you. You don’t have a desktop version of your account and expense data to view – just apps.

Bottom line on Apple Card

If you’re an Apple fan who wants to work less with a physical wallet and more with a phone, it’s worth applying. If you’re just looking for a different reward card, look elsewhere. A regular money back card can probably help you earn a higher rate of reward for all of your expenses, including Apple products and apps. I don’t think you will see Apple Card in the list of “best money back cards” any time soon.