This Tool Calculates How Much of Your Investment Fees Stack up Over Time

When you buy and hold a mutual fund in your retirement account, you pay a specific rate of expense , which is basically a commission to the firm that manages the fund. Typically expense ratios range from 0.15% to over 1% , which doesn’t seem like a big difference. Over time, however, the expense ratios add up, and this calculator will show you exactly how much.

The Dinkytown Investment Fee Calculator allows you to compare expense ratios for three different funds at the same time. You enter your balance, recurring savings and commissions, and you can see how your balance grows over time depending on the commission.

For example, the chart above shows what a $ 100,000 investment looks like over the years with an expense ratio of 0.10%, a ratio of 0.20%, and a ratio of 1.5%. Here is the 20-year profit for each expense ratio:

- Expense ratio 1.5%: $ 291,776

- Expense rate 0.20%: $ 372,756

- Expense rate 0.10%: $ 379,799

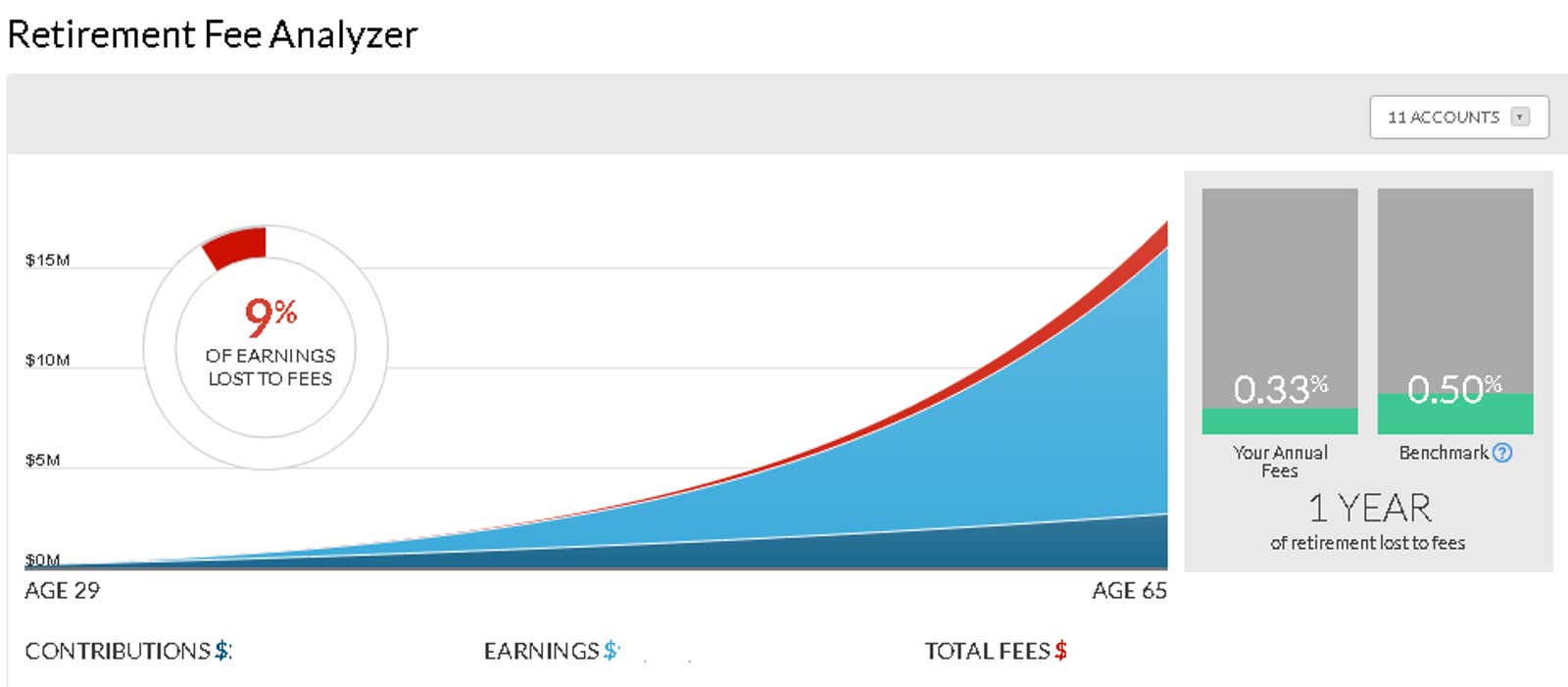

You can see how much of a difference even a 0.10% increase over the years can make. If you’re not sure how much you pay for investment fees , you can use an investment checker tool like FeeX or Personal Capital to see what your spending ratios really are. Then plug them into your calculator and see how they add up over time.

Compare Investment Fees | Dinkytown