Lifestyle Inflation Isn’t Always Bad

Personal finance isn’t about living the rest of your life as a poor college student. Cost and lifestyle inflation is getting a bad rap, but they are not necessarily enemies when it comes to your finances. It’s more about how you approach spending. You want to find a balance between enjoying life and saving money.

What is lifestyle inflation?

Let’s say you got a big increase of 10% this year. And instead of spending that money on paying off debt or investing your savings, you use it for a more comfortable life. You are moving to a nicer apartment. You go to trendier restaurants. This is called lifestyle inflation, and in the world of personal finance, this is never a good thing. Experts warn against this because, as consumers, we tend to consume too much and end up paying the price later.

Basically, I don’t think there is anything wrong with lifestyle inflation. I definitely don’t live like college, which is good. At the same time, when lifestyle inflation makes it difficult to get out of debt, save up for retirement or get out of the pay cycle, that’s when it becomes a problem. Some people define lifestyle inflation in terms of these issues, which may be fair because they often go hand in hand.

The case versus spending: it gets out of hand

The world of personal finance hates spending for one reason: it can easily ruin your finances. Take the Diderot effect , for example. This is what happens when you buy something, realizing that it doesn’t fit your current sense of style (or even identity), so you buy a bunch of extra crap to change yourself or your sense of style.

The term was named after the French philosopherDenis Diderot, who wrote an essay titled ” I’m sorry to part with my old robe .” He writes that he was presented with a new beautiful robe, which he loves. Only because of this, all the rest of his things look like shit. To fix this, he buys a bunch of new pieces for this beautiful new dress. Diderot writes:

I was the absolute master of my old robe … but I became a slave to my new … Beware of sudden wealth contamination. A poor person can relax without thinking about appearance, but a rich person is always tense.

This is lifestyle inflation in action. There is nothing wrong with buying new things as your income changes, but the problem with the Diderot effect is that ongoing spending is related to your personality. The problem is that your personality is very important to you, so you become a big, unstoppable spending machine .

Likewise, we can fall prey to hedonistic adaptation . When something new and cool is introduced into your life, this new and cool thing can suddenly become the new normal, and now it takes something even newer and cooler to satisfy you. You can probably see how this can lead to cost problems. You buy a new fancy phone, you get used to all its interesting features, and you will never again be able to imagine yourself going back to your boring old clamshell again. In fact, you want everything in your life to be as comfortable and intuitive as your phone, which is why you buy a tablet, Roku and Nest … even if you can’t afford them.

Spending is good, but it often results in you spending more than you earn. When the math doesn’t add up and you get more out than you get, it leads to problems. Lenders start calling, you can’t get loans, you find it difficult to make ends meet, and all the other awful things that come from a lack of money. The bottom line is that lifestyle inflation costs money. If you are happy with your lifestyle, why spend more on improving it when you can use that money for something more important?

The case for spending: what else is the money for?

On the other hand, what’s wrong with spending money? At the end of the day, this is what it is for and this is what you work hard to get every day. As long as it doesn’t take away any other purpose from you, it’s not so bad to use money to enjoy life a little.

People are denied personal finances because they think the point is to sacrifice pennies and give up the things and experiences you love. Personal finance is not the life of a beggar. Yes, there is frugality in personal finances, but this is just one way to achieve your goal. Saving without a goal doesn’t make much sense, but smart saving does . Thus, personal finance does not reject spending – in fact, it does. You save to spend money .

Here’s how Ramit Sethi from I Will Teach You To Be Rich describes his approach to money:

I’ve decided to focus on helping people define wealth and spend wastefully on what you like while relentlessly cutting back on what you don’t like. I focus especially on psychology and automation because none of us wants to be a financial “expert” – we just want our money to do the right thing so we can live our lives.

We “want our money to do the right thing” to be sufficient. And we want enough of them because we want to spend them! I’m not saving for retirement because I’m responsible and boring; I’m procrastinating because when I’m retired I want to do a bunch of fun things. At the same time, now I also want to do funny things. As much as I love the cheap noodles in the cup, I don’t want to eat them every night, and it’s nice to be able to turn on the air conditioner when I’m hot instead of sweating because I might “ not have to pay my electricity bill. Since I was 20, my lifestyle has definitely changed. But I would also like to improve my retirement lifestyle: living abroad, dining out whenever I want, and traveling all the time. It costs money.

The key to success is finding a balance between saving for the future and enjoying the present. You want to spend money wisely, but the goal is still to spend it . Spending is not a bad thing.

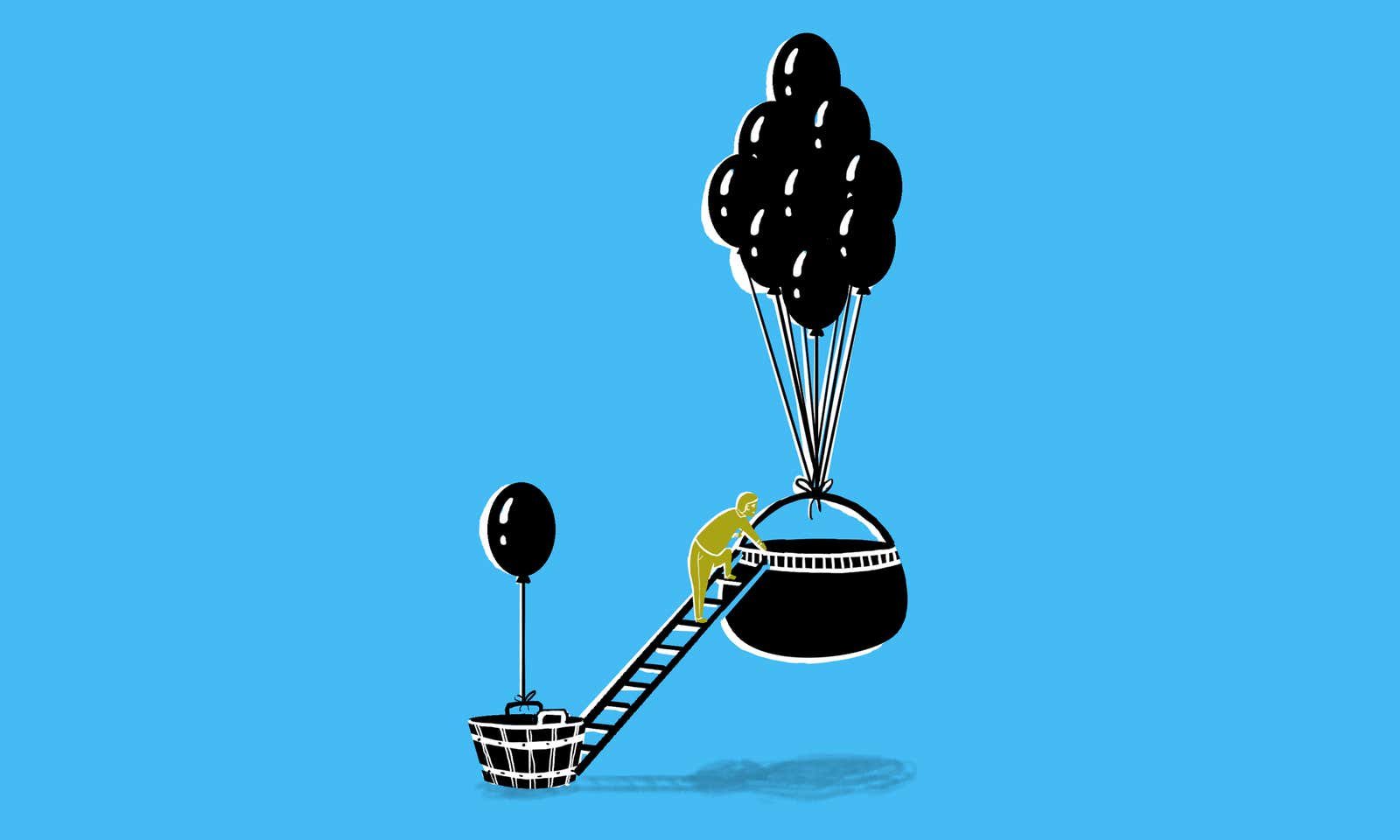

Money is just a tool

Money is a tool, and personal finance helps you understand how to use this tool in the most beneficial way for you. This could mean spending money on travel or animal amenities. As long as it is a sustainable and affordable lifestyle, you are not doing anything anti-personal about your finances just by spending money.

Be wary of lifestyle inflation. This will help you avoid overspending. But they are not the same thing, and it’s all about finding the right balance between the two with conscious spending . Financial columnist Will Lipovsky says:

Targeted lifestyle inflation means you’ll be spending money on travel this year because that’s a passion. Or you may use an expensive face wash in the morning because it will make you feel rejuvenated.

Unintentional lifestyle inflation means spending money without even realizing it. You eat out every night without even thinking about it. You drive a $ 30,000 car when you would be perfectly happy with a $ 5,000 car. This is dangerous. But targeted lifestyle inflation … that’s okay.

There are several helpful ways to spend consciously to find a balance between spending and overspending. Some time ago I wondered if I should move to a nicer and more expensive apartment in my house. I could afford it, but it didn’t necessarily mean it was a smart financial move. I wrote about the steps I took to decide whether to increase my lifestyle spending. Here’s what it led to:

- Look at your budget : If you literally can’t afford the new spending and it makes your financial situation precarious, just stop and forget about it. You don’t want to go into debt or stretch your finances. That’s when lifestyle inflation becomes a problem.

- Consider the opportunity cost : Even if you can afford it, the new expense may still be at the expense of your other goals . Think about how the cost of a new lifestyle will affect your retirement goals or whatever else you’re saving for.

- Consider the Long-Term Implications : Consider what spending problems these new spending might cause. I knew that if we moved, we would be tempted to buy new furniture suitable for the place (the Diderot effect), so I put that in my budget when I was weighing my decision. Basically, you want to know how the increase in lifestyle spending will affect your budget as a whole and in the future.

Lipovsky offers a useful strategy that we discussed earlier: Focus on percentages . Spend a certain percentage of your income on housing, luxury goods, savings, and so on. Thus, as your income increases, the value of each category of spending and savings remains the same. You will be able to save more and also be able to lead a better lifestyle.

On the other hand, if you want to cut inflation, you need to focus on saving money and making a plan to cut your lifestyle .

Some might argue that lifestyle inflation is defined by the fact that you are living beyond your means, and that is one thing. But just spending money is not a bad thing. In general, money is just an instrument of financial freedom. It’s okay to spend it and live a better lifestyle than you did during your college days. You just don’t want to spend to the point where you are at the mercy of money instead of controlling it.